Getting your NMLS license can feel like a complex process, especially when you’re just starting out. But with guidance from experienced mortgage educators, the path becomes clear and manageable.

Whether you’re transitioning careers or starting fresh in the mortgage industry, here’s a simple, efficient plan to help you move from interest to licensure with confidence.

1. Understand the Licensing Requirements

The first step in the licensing process is completing the 20-hour national SAFE course, which is required in every state. In addition to the national component, most states require an extra 2 to 15 hours of state-specific education.

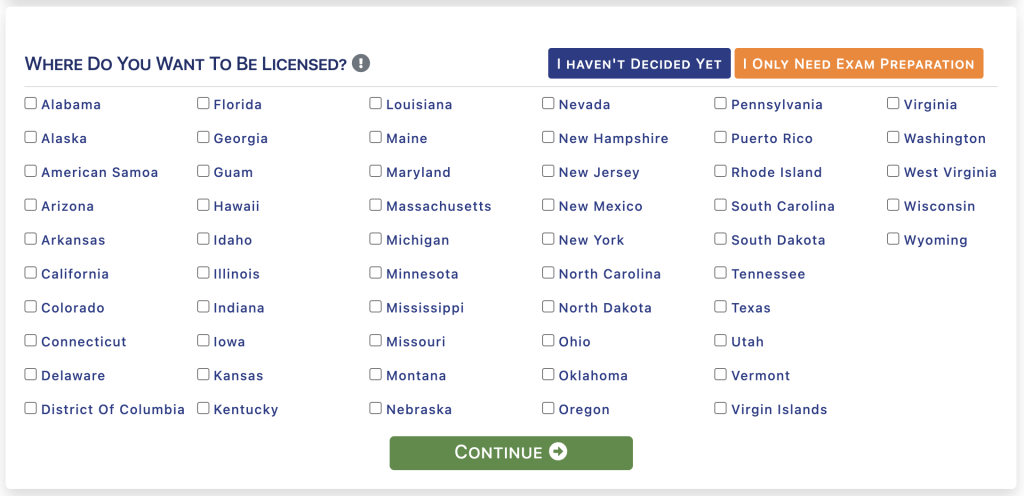

To avoid delays or missed steps, it’s important to review your state’s specific licensing requirements on the NMLS Resource Center. Many mortgage educators offer bundled courses that include both national and state components, making it easier to satisfy all requirements in one place.

2. Select the Right Education Provider

Choosing a reputable mortgage educator is one of the most important decisions you’ll make in the licensing process. The right provider will offer flexible course formats and support systems that match your schedule and learning style. Look for:

- Self-paced online courses that allow you to study around work or family commitments

- Flexible learning formats: Options include self-paced online courses, webinars, and instructor-led sessions.

- Prompt reporting of course completion directly to the NMLS

Well-established mortgage educators prioritize convenience, compliance, and clarity, making it easier for students to stay focused and on track.

3. Create a Manageable Study Routine

Rather than cramming or delaying progress, consider adopting a steady weekly routine that fits your life. An example of one effective approach is the “3-2-1” method:

- Three hours per week watching new course content

- Two hours completing practice quizzes

- One hour reviewing notes, flashcards, or summaries

This routine helps reinforce learning, build confidence, and reduce test-day anxiety.

4. Schedule the NMLS Exam Promptly

Once you’ve completed the required coursework, don’t wait to schedule your NMLS exam. Booking the test within 48 hours of finishing your course ensures the material stays fresh and keeps your momentum going.

Many education providers also provide optional test prep tools, including practice exams and review guides. Taking advantage of these resources can improve your readiness and increase your chances of passing on the first attempt.

5. Prepare for Continuing Education Early

Getting licensed is only the beginning. To maintain your NMLS license, you’ll need to complete eight hours of continuing education (CE) annually. It’s a good idea to plan for this early.

Experienced mortgage educators often offer CE bundles or discounted renewal packages, helping you stay compliant without last-minute stress.

Conclusion

Becoming a licensed mortgage loan officer doesn’t have to be an overwhelming process. With the support of a trusted education provider and a well-structured approach, you can complete your training, pass the NMLS exam, and begin serving clients with confidence, often in just a few weeks.

If you’re ready to begin, explore our NMLS-approved licensing courses and take the first step toward your mortgage career.